Blog

Making Manufactured Housing More Secure and Affordable

There are 2.7 million owners of detached single-family homes that do not own or control the land beneath their homes. They own their home and rent the land in one of the country’s roughly 50,000 Manufactured (“Mobile”) Home Communities (“MHCs”).

Since 2009, we have provided financing to Resident Ownership Capital (ROC USA)®, a national community development financial institution (CDFI) that finances the purchase of the land by a cooperative of the homeowners. Recently we renewed and increased our loan to them for up to $5 million.

ROC USA is scaling nationally the MHC resident ownership model that New Hampshire Community Loan Fund (NHCLF) developed beginning in 1984. The NHCLF has financed the purchase of 123 MHCs in New Hampshire and developed the necessary pre- and post-closing technical assistance programs for the resident-owned communities (“ROC”).

Our financing supports ROC USA Capital’s mortgage loans to cooperatives formed by homeowners in MHCs. This loan increase will specifically support the expansion of ROC USA Capital’s products in the states it currently works in and support expansion into Colorado.

Manufactured housing is affordable, but residents face challenges

Manufactured housing is generally regarded as the largest source of unsubsidized affordable housing in the U.S. An average manufactured home (also commonly known as a mobile home, a type of prefabricated house built entirely in a factory and then delivered to a site) costs $45/square foot, compared to $100/square foot for a site-built home (a home built on the site it occupies).

Manufactured housing is generally regarded as the largest source of unsubsidized affordable housing in the U.S.

Approximately two-thirds of owners also own the land (or site) on which their home is located. But, one-third of home owners do not own the land beneath their homes, which can be problematic. Residents who do not own the land are at the mercy of landowners regarding potential rent increases, community rules, infrastructure investment and maintenance, and community closure due to change in use. These homeowners essentially do not have much control over their biggest financial asset.

Residents are faced with few options if they can no longer live in their community due to park closure or an increase in rent that they cannot afford. Often, they do not have the financial resources to move and cannot afford another home. Moving a “mobile” home is expensive and impractical. The cost of relocating a home is usually between $6,000 and $10,000. Because their homes are difficult and costly to move and because residents often have few or no other housing options, they are especially vulnerable to exploitation in the form of high rents and poor services.

Residents also have a hard time accessing affordable financing for manufactured home purchase and upgrades when they do not own the land under their home. In most states, a manufactured home is titled as personal property rather than real estate property if the land is not owned. Personal property loan borrowers have fewer consumer protections than mortgage borrowers and are usually subject to higher rates.

ROC USA helps homeowners become community owners

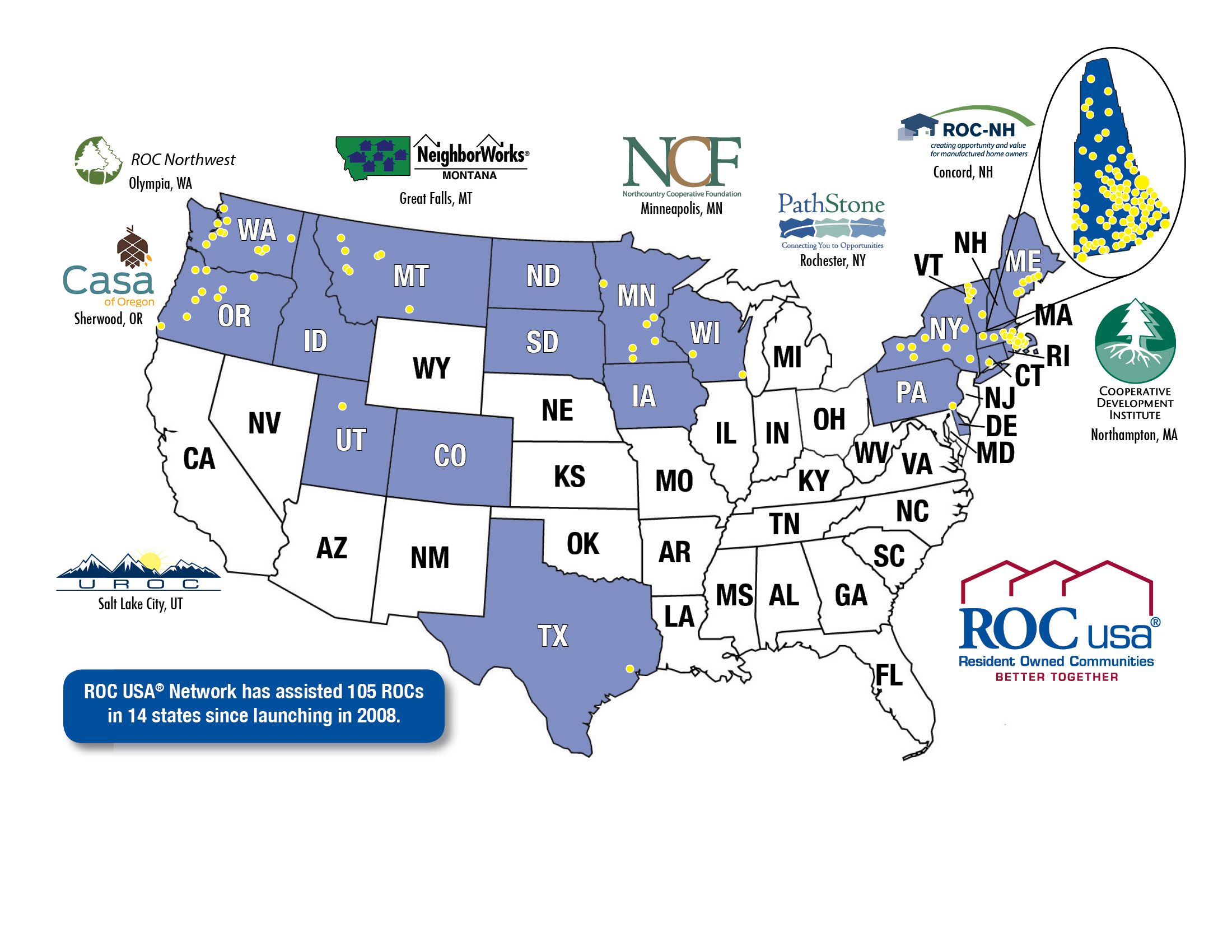

This is where ROC USA’s work comes in. ROC USA preserves MHCs by helping the homeowners become community owners through a democratic cooperative. ROC USA provides ongoing training and technical assistance through its network of Certified Technical Assistance Providers, a network of currently nine affiliated non-profits that operate in 22 states and regions. The goal is to permanently preserve affordable communities and provide homeowners the security of land ownership—enabling their homes to appreciate as a comparable site-built home would.

Map showing ROC USA's growth in communities across the country. More at https://rocusa.org/simple-question-yields-terrific-answer. Image courtesy ROC USA.

This shift to a cooperatively-owned park can stabilize rents, enable residents to access more affordable financing, and provide security to residents that their community will not be sold from under them. They can then more confidently make capital investments in their homes. Communities led by residents can also make appropriate capital investments and investments in needed services—making the community more live-able.

ROC USA conducts third-party rent studies every five years to determine affordability relative to area market rents. Thus far, rents at ROCs in ROC USA Capital’s portfolio range from at market to as much as 17% below market after five years of ownership. Further, those borrowers are also reserving for improvements as scheduled by an engineer and are reviewed or audited annually by a CPA. ROC USA is focused on strong underwriting and good financial management as well as leadership development and healthy democratic decision making.

Thus far, rents at ROCs in ROC USA Capital’s portfolio range from at market to as much as 17% below market after five years of ownership.

MHCs are threatened when alternative land use values increase. Recent MHC closures have resulted in homeowners committing suicide as in a recent case in Minnesota. Community closures are often devastating to homeowners. Opening new MHCs is difficult as local authorities are often reticent to grant permission for new communities, due to the stigma associated with manufactured housing. As the stock of affordable housing in the U.S. decreases and MHCs are closed, ROC USA’s work to preserve this type of affordable housing is increasingly needed.

Through our investment we aim to grow ROC USA’s important work and increase access to affordable, quality housing for individuals and families across the country. We know that affordable housing creates the foundation for equitable, thriving communities, and can be achieved with the right financing and support.