Blog

University Endowments and Impact Investing

College and university endowments, which represent $400 billion in combined assets under management in the United States, have a diverse group of stakeholders competing for a say in how they are managed. Increasingly, these stakeholders – students, alumni, trustees, university staff – are pressuring endowments to incorporate Environmental, Social, and Governance (ESG) considerations into their investment practices.

This month, the Investor Responsibility Research Center Institute and Tellus Institute jointly released a report on ESG investing by endowmentsthat reviews:

- The incorporation of ESG criteria into endowment management

- Shareholder advocacy and active ownership initiatives

- Governance and transparency in endowment investment decision-making

We were especially interested in the section of the report that analyzed community investing and microfinance (both of which would commonly come under the purview of “impact investing”). The report uses a standardized definition for community investing: “directing capital from investors and lenders to individuals, institutions, or enterprises in communities underserved by traditional financial services.” While this definition may be familiar to many of us working in the field, the report highlights a definite lack of clarity among universities. For instance, some endowment managers have self-reported grant activity or geographically targeted private equity as community investments. Many schools have made significant investments in real estate projects in the communities surrounding their campuses, but they have not clearly articulated a commitment to underserved populations as the underlying purpose for these investments. Are these community investments? Not by the definition set forth in the report.

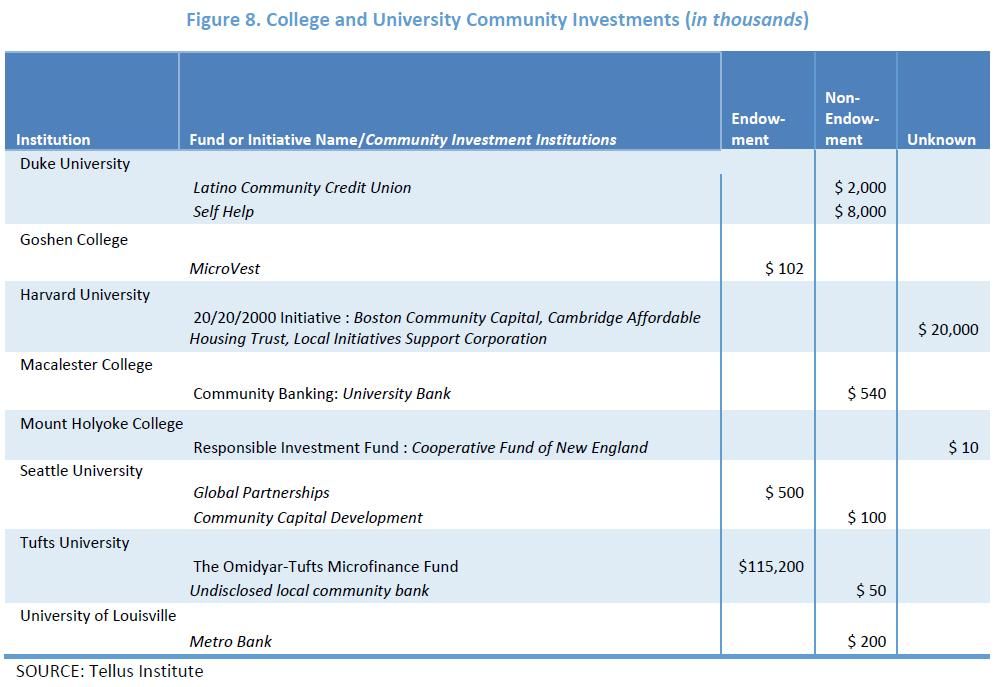

It is also interesting to note that several schools do not use endowment assets for community investing or microfinance, but instead use their operating budgets. This is surprising, and further underscores the highly restrictive nature of endowment investment policies. A list of universities that have reportable community investment activity is below.

The conclusion of the report provides both reasons for optimism and pessimism: “Endowment investing around ESG issues today is rather less than meets the eye. On one hand, there appears to be a proliferation of initiatives to encourage more sustainable and responsible forms of endowment management. Yet on the other hand, as we have repeatedly seen, some colleges are regularly self-reporting unverifiable data about their ESG investment policies and practices, which upon investigation prove to be overstated.”

What will it take to get colleges and universities to truly “walk the walk”? Ultimately, pressure from within university communities is the most likely driver for real change. Ample resources exist for university administrators to get educated about ESG, impact, and community investing, but unfortunately, endowment managers are largely absent from these discussions.

Interested in how your alma mater fares with respect to endowment transparency, investment practices, and shareholder engagement? Check out the College Sustainability Report Card, a rating system made available by the Sustainable Endowments Institute. My school scored an A-…not bad!

Follow Ryan Steinbach on Twitter: @R_Steinbach.