Blog

2018 in Review

2018 was an important year. Against a backdrop of global and political turmoil, we saw an industry of doers organize more urgently around the common call for greater transparency and accountability in our global financial markets. Motivated by the SDGs and new realities of climate change, our peers and partners pushed forward to build new solutions. We are humbled to play a role in this movement.

It was a busy year. As we go into the holidays, we reflect on the many moving parts of our business, excited by what our team has accomplished. We look forward to time with our families so we can relax, recharge, and enter 2019 ready to tackle the new challenges and opportunities ahead.

Engaging investors to get more money moving for impact

2018 impact report shares deeper insights and our measurement methodology

At Calvert Impact Capital, "impact" is our middle name. We strive to provide authentic and transparent impact reporting that our investors value. As the impact investing field grows, and the practice of impact measurement advances, we will continue to evolve our practices and experiment with ways to better articulate our impact. Our 2018 Impact Reportprovides more detailed insight into how we capture and evaluate our impact, outlining our role in creating and strengthening the infrastructure needed to move capital from investors to communities. It offers more impact data and case studies to demonstrate how our financing helps our borrowers build, grow, and sustain their impact on the communities they serve.

Read More:

Changing Markets, Changing Minds: Our 2018 Impact Report

Survey reveals motivations and challenges of impact investors

Every other year, we conduct an investor survey to understand the motivations and challenges of our investor base. This year we went one step further, opening our survey beyond our investors to the broader impact investing industry. Our results echo familiar findings from across the industry: interest in impact investing is high, but current portfolio allocation is low. Investors want more opportunities to invest for impact, especially around climate change solutions, and they also want better guidance on how to do so. Everyone in the industry – investors, advisors, product providers, and distributors – has a role to play in making the process more accessible. Check out our calls to action for investors, advisors and the industry at large:

Read more:

5 Things to know about our Impact Investors: 2018 Edition

New website feature helps you better understand our portfolio

We're proud of the organizations we invest in and our new portfolio listgives them more space to shine. This new section on our website lists each of the investments in our portfolio, currently more than 120 organizations operating in nine sectors with exposure to more than 100 countries around the globe. Each organization has its own page, with summary information and content that demonstrates the impact of their work. If you're interested in something specific, you can search and sort by sector, location, and initiative. The list helps showcase the breadth and depth of the work we finance and makes it easier for investors to understand the incredible reach of their dollars when they invest in our Community Investment Note.

Higher rates on our Community Investment Note

In 2014 we undertook a new portfolio strategy, intended to strengthen the financial intermediaries who provide much-needed capital in their communities. They are addressing some of the most pressing issues of our time—climate change, wealth and income inequality, housing stability, natural resource preservation, and gender equity—and we strive to provide them useful capital to expand their work. Since implementing our new portfolio strategy, demand for our capital has skyrocketed. To keep pace with the demand, we raised rates on our Community Investment Note® in June. By raising rates, we are providing appropriate returns to investors along with intentional impact, and ultimately getting more capital into the communities that need it.

Read more:

More money, more mission: Raising our rates to meet portfolio demand

Re-built investment platform offers better experience

Since building our own online investment platform in 2014, we've sought feedback from our investors and committed to continually improving the investing experience. In August, we launched our completely re-built investment platform, featuring simplified design, easier bank account linking, and new security technology so investors can access their accounts seamlessly online. If you're an investor, please keep the feedback coming – your voice is critical to helping us make ongoing improvements in 2019--including offering online access to previously paper-based investors.

Read More:

Our new investment platform goes live

Building and growing impact markets to create sustainable and resilient change

Syndications service creates market efficiencies and moves more capital

In 2017 we launched our Syndications services, a new line of business designed to create efficiencies in the impact investing market and accelerate the volume of capital flowing to communities in need. By structuring and administering investable transactions, our syndications services connect mission-driven organizations trying to raise money with investors interested in impact opportunities. We have syndicated and/or administered eleven deals representing over $185 million invested in communities since launching the syndication services. Deals we have syndicated include the UP Community Fund, which provides capital and technical assistance to entrepreneurs of color in the southeastern U.S. who don't have access to traditional finance, and Community Housing Capital, who is addressing the critical lack of flexible financing for affordable housing. We're currently raising capital for innovative solar funds, affordable housing developers and more, and look forward to exciting new opportunities in 2019.

Interest in blended finance continues to grow

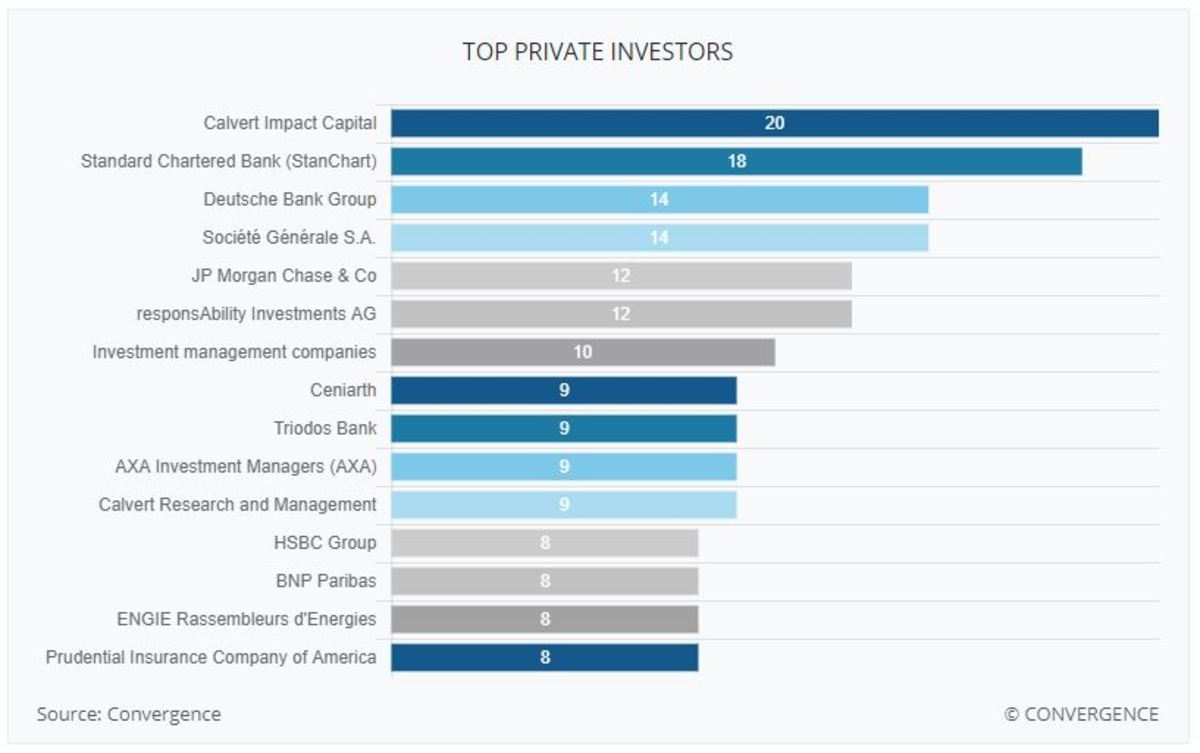

In 2018 Calvert Impact Capital was ranked as the top impact investor in blended finance deals, as measured by number of transactions. Blended finance, – the practice of using concessionary capital to reduce the real and perceived risks to crowd-in private capital - is an effective tool as we build and de-risk new sectors. We work with diverse partners on blended finance transactions, including OPIC, USAID, Shell Foundation, Prudential and others. Blended finance was an increasingly hot topic this year and is emerging as a key tactic to engage private capital at the volume and scale required to address the SDGs. As interest in blended-finance grows, we've shared some of our lessons learned on how to structure blended finance deals effectively with the goal of increasing the amount of private capital participating in impact investing deals.

Source: Convergence Report, "The State of Blended Finance 2018"

Read More:

Member Spotlight with Najada Kumbuli of Calvert Impact Capital

Blended Finance: what is it, what it isn’t and how to use it for maximum impact

Why Understanding The Financial Supply Chain Is The Key To Moving More Impact Capital

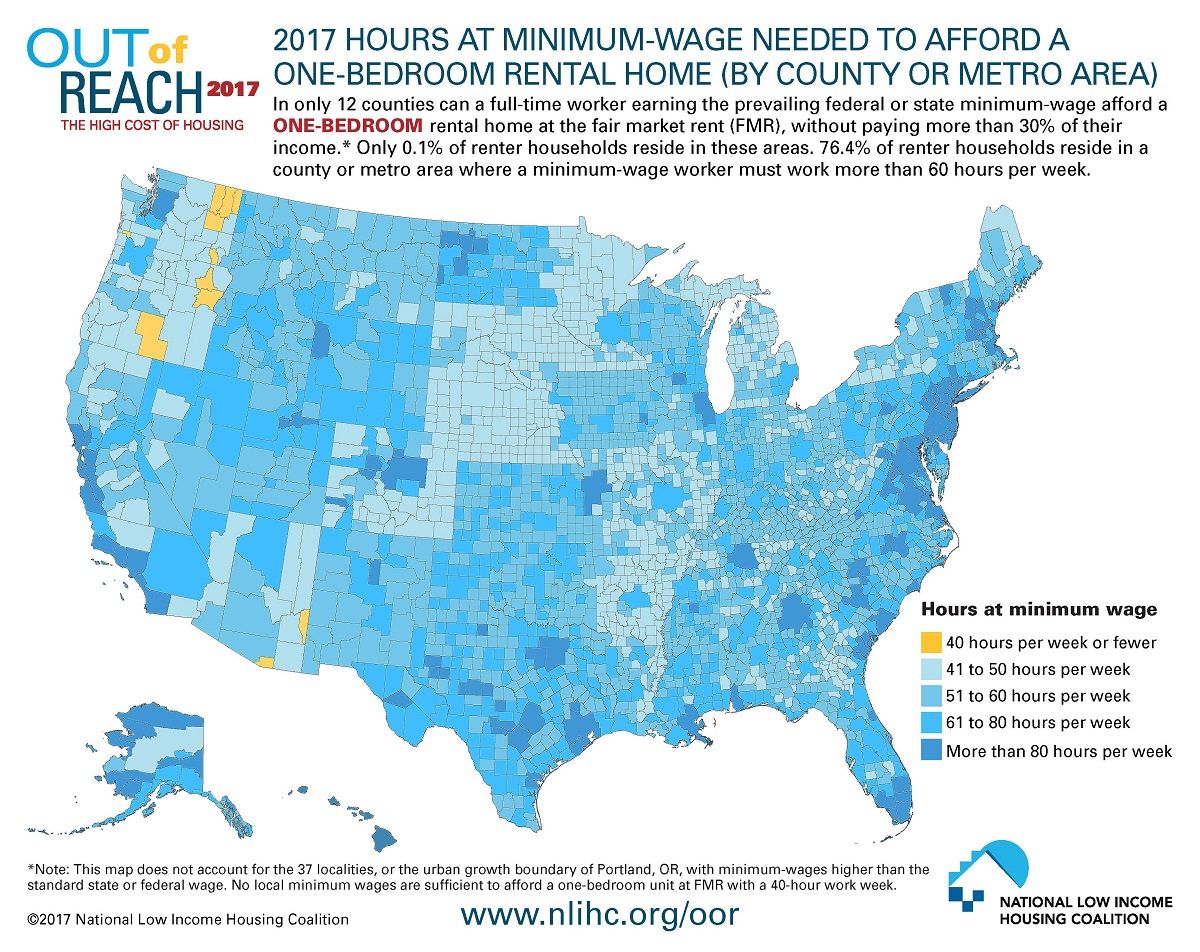

Renewed call to action to invest in affordable housing

Calvert Impact Capital has been dedicated to the preservation and development of affordable housing since our founding, but it is not always a popular sector among investors new to the impact markets. Catherine Godschalk, our VP of Investments wrote an article addressing the lack of interest in affordable housing investment opportunities from the impact investing community, the very serious affordability crisis we face across America, and the powerful impact that secure housing creates for individuals, families and communities. To educate more investors, we hosted an impact tour of several developments in Raleigh, NC, financed by our borrower Community Housing Capital, to show investors and financial advisors how their investments have an impact on families and communities.

Read more:

Dear Impact Investors: Consider Affordable Housing

Making Manufactured Housing More Secure and Affordable

Demonstrating our commitment to preserving affordable housing through a new Enterprise investment

The Power of Community Engagement in Affordable Housing: Takeaways from the #ImpactTourRaleigh

Stepping up our climate-focused investments

In 2018 we increased our financing to climate-related opportunities, with investments in two first-of-their-kind-deals: the Seychelles Blue Bond and the Forest Resilience Bond. These investments reflect our goal of investing to build natural resiliency and mitigate the risks of climate change. We've heard loud and clear from our investors that climate change is a top issue of concern, and we will continue to grow our exposure to opportunities that make our planet more resilient and sustainable.

Read More:

A Royal Visit Led This Indian Ocean Nation to Invent a New Bond

Seychelles sells world’s first blue bond in ‘dolphin debt’ deal

Forest Resilience Bond: a new mechanism for fighting fire with finance

Start-up Blue Forest Secures Financing for First Privately Financed Forest Fire Bond

Expanding our work to meet the evolving needs of the industry

Sharing what we've learned on a bigger stage

Our current strategic plan outlines a renewed focus on thought leadership to share our lessons and experiences with a broader audience. This year we prioritized creating content on key industry issues (e.g. blended finance and gender equity) and by doing more intentional media engagement. You can find this material compiled on our new Insights page and on our Mediapage.

Our CEO Jenn Pryce was invited to become a Forbes contributorand has been making the rounds on broadcast programs like Bloomberg Daybreak Americas. We look forward to developing new partnerships for engagement and experimenting with new mediums next year.

Watch Jenn on Bloomberg here:

Three Ways to Approach Impact Investing in Africa- Jenn Pryce, president and chief executive officer at Calvert Impact Capital, explains her firm's approach to impact investing in Africa and where the best opportunities are in the market. She speaks on "Bloomberg Daybreak: Americas."

Read Jenn's recent Forbes articles here:

Don't Just [Let It] Sit There; Do Something

Impact Investors Need To Think Big - And It's Not What They Think It Means

There's A $6 Trillion Opportunity In Opportunity Zones; Here's What We Need To Do To Make Good On It

Legendary Investor's Embrace Of Sustainable Investing Is New, But The Movement Isn't

Why Understanding The Financial Supply Chain Is The Key To Moving More Impact Capital

Gender lens events reach hundreds of investors

This year, with support from Shell Foundation, we organized a series of investor events to demystify the practice of gender-lens investing and get more capital moving. We hosted and participated in events in Zurich (2017), Hong Kong, Lisbon, Kampala, New York, D.C. and Paris, reaching hundreds of investors and gaining new insights along the way (which you can find in our comprehensive gender-lens investing report, described below and published in December). We developed and shared two tools to help investors get started in creating their own gender-lens investing strategies. Check them out below:

Read more:

Key Questions for Underwriting Gender Equity

Addressing SDG 5: How to incorporate gender into your investment strategy

Our gender report explores link between gender diversity and financial performance

In December, we released our comprehensive report on gender lens investing called "Just good investing: why gender matters to your portfolio and what you can do about it." The report includes an analysis of Calvert Impact Capital's portfolio over 11- years representing a cumulative $23 billion in assets that explores the link between gender diversity and financial performance as well as straightforward guidance for investors on how to incorporate gender into investment strategies in three steps. We hope this report helps investors appreciate that gender is not niche, but fundamental to understanding risk, opportunity, and impact.

Read More:

Just Good Investing: Why gender matters to your portfolio and what you can do about it

Private Companies Benefit From Women at the Helm, Calvert Impact Capital Finds

New Report Furthers the Business Case for Gender Lens Investing

Making sense of Opportunity Zones

One of the biggest impact investing developments in 2018 was Opportunity Zones, created through The Tax Cuts and Jobs Act. The legislation provides tax forgiveness to investors who invest in more than 8,000 designated, low-income Census tracts across the U.S. In August our CEO Jenn Pryce wrote about the potential and challenges of Opportunity Zones, and in December the Kresge Foundation chose us to provide technical assistance to help potential Opportunity Zone fund managers bring their investment opportunities to market. Next year we will to continue explore the ways we might leverage our platform to help deliver on the promise of Opportunity Zones to get capital to communities that need it.

Read more:

There's A $6 Trillion Opportunity In Opportunity Zones; Here's What We Need To Do To Make Good On It

New incubation program opens to help social impact orgs ready for Opportunity Zone funds

Thanks for a great 2018, and see you next year

Phew, 2018 was a busy year! We want to thank you for your partnership, your investments, your feedback, your tweets and likes, and all the other ways you've helped us become a stronger organization. We look forward to working with you next year to make the world more equitable and sustainable.

Sign up for our email updates below to get the latest happenings.