Reports

Our 2023 Impact Report, "Demonstrate, Educate, Transform"

Our 2023 Impact Report

Please find our 2023 Impact Report below, or download.

A message from our President and CEO Jennifer Pryce below:

November 2023

The theme of our 2023 Impact Report is Demonstrate, Educate, Transform, which gets to the heart of what we do at Calvert Impact. Nearly 30 years ago, the Community Investment Note® was created to demonstrate that it is possible for everyday investors to use their investment portfolios – no matter how big or small – to drive solutions to social and environmental challenges. Since then, our investors have enabled more than $2.5 billion to be invested into 600 local community and green finance providers. This includes problem solvers like Artspace, highlighted on page 13, which develops and manages affordable and workforce housing for artists across the country; and innovative models like the Forest Resilience Bond, highlighted on page 7, which finances healthier forests against the backdrop of a changing climate. These are two examples of many who, collectively, have generated the impact on the nearly 150 million lives that you see in these pages.

Just as importantly, we have used lessons from the Community Investment Note® to educate the broader market on where we see persistent gaps, where capital is not flowing and why, and how others can join us. We have supported the development of more than a dozen other private note programs, syndicated more than 30 credit facilities, and shared our thought leadership on what we’ve tried, what we’ve learned, and how to join us in the fight for a better, more equitable financial system.

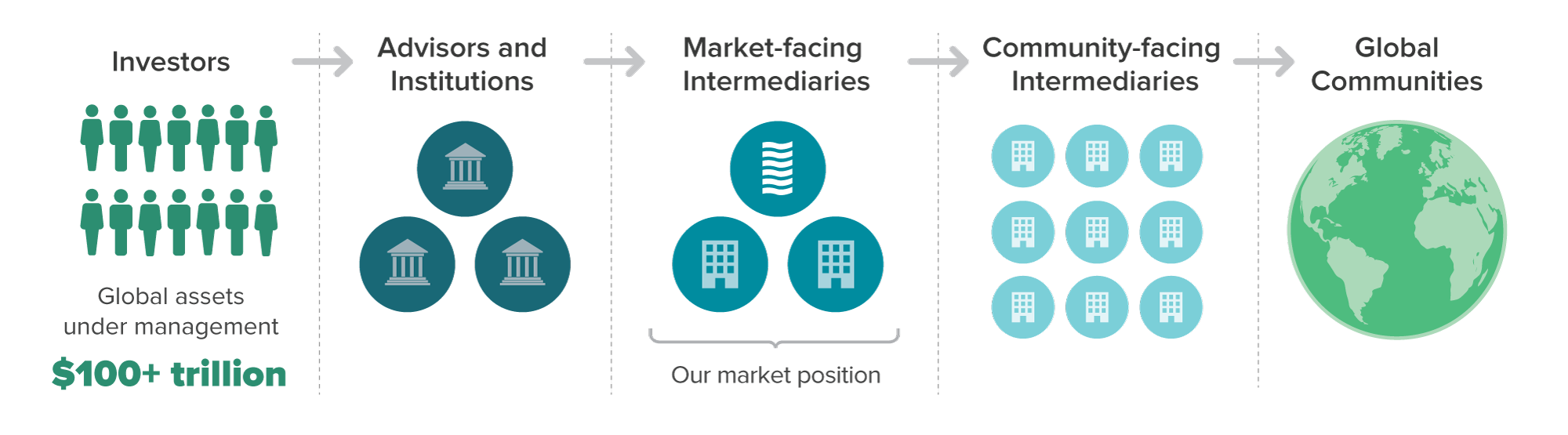

This is what it will take to truly transform the capital markets. It requires an organized value chain of actors – as seen in the visual below – to rebuild the broken links that exist between the capital markets and global communities. Our role is as translator between the needs of investors on the left – scale, diversification, standardization, and liquidity – and the needs of our portfolio partners on the right – flexibility, understanding of their markets, and values alignment.

We have witnessed the capital markets begin to transform through our flagship product, and we are ready to replicate and expand. In 2023 we issued a new product, the Cut Carbon Note, a $400 million offering that decarbonizes buildings so investors can directly support a healthier planet and cleaner air. This product was built with our partners PACE Equity and the New Buildings Institute and works across the ecosystem – building developers, clean technology suppliers, tenants, architects, and engineers – to change current building practices to drive to a net-zero future. With this unique and innovative program, we intend to demonstrate how responsive financial products can motivate change, educate our broader networks on the benefits of green building design, and transform the asset-backed credit markets into drivers of decarbonization. You can learn more about the Cut Carbon Note and all of our new products and services on page 4.

The urgency of our shared challenges calls for bold action, now. In our industry, that means turning the innovation of the past into the replicable, scalable products of the future. With your support, we have proven that it can be done and we’re ready to do it again and again. Join us.

Jennifer Pryce President and CEO