Blog

2020 in Review

2020 was a challenging year. The global pandemic, resulting economic shocks, stark displays of systemic racism and injustice, and near-daily evidence of a rapidly changing climate have made it clear our current systems are failing us. Throughout 2020, our team rolled up their sleeves, attempting to meet these challenges by continuing to do what we do best: connecting capital with communities that need it. As the year comes to a close, we reflect on milestones accomplished in our 25th year and recommit to creating a more equitable and sustainable world over the next 25 years and beyond.

Marking our 25th Year

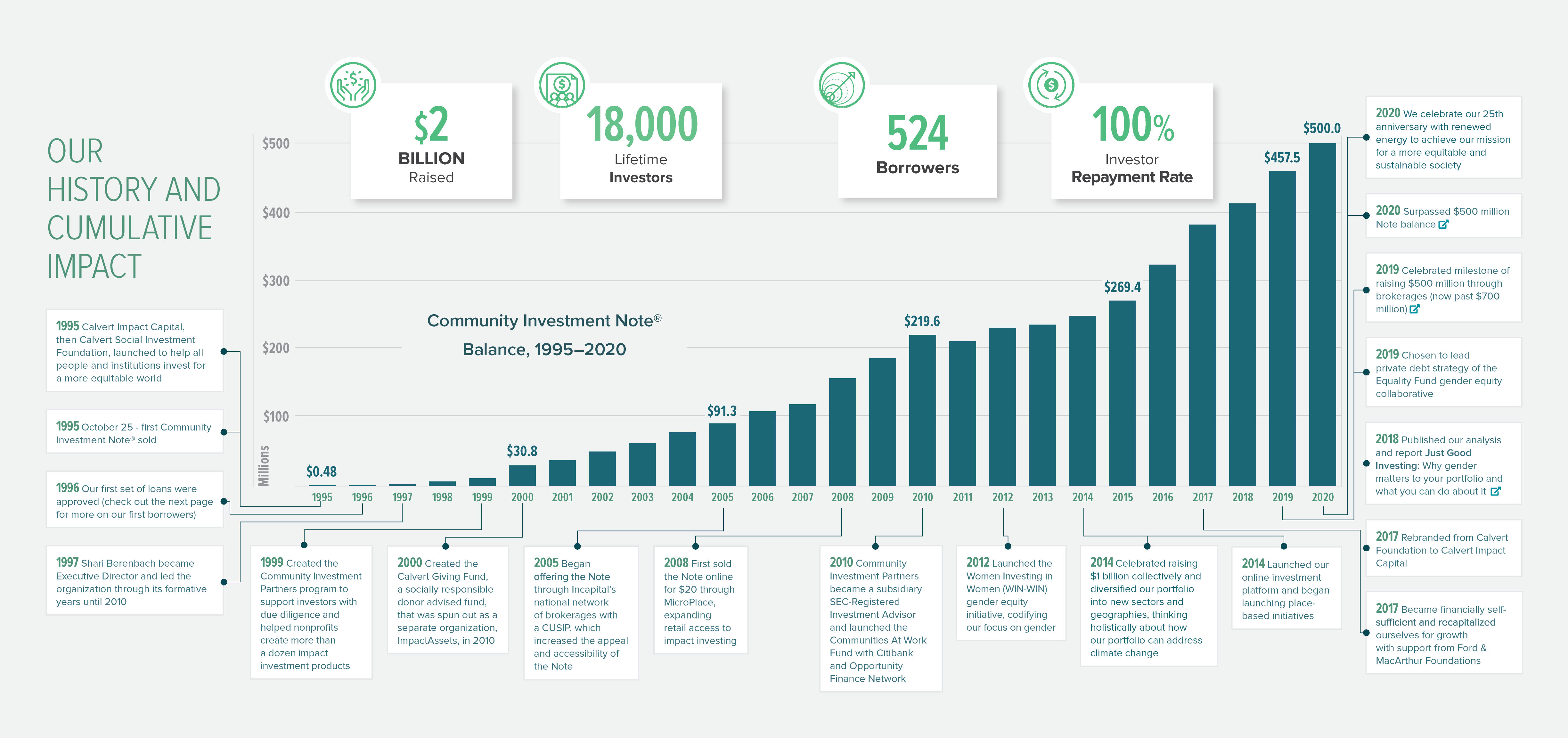

Over the past 25 years, we’ve made nearly 1,000 loans and investments to over 500 organizations across 100+ countries, supporting hundreds of thousands of businesses and benefitting millions of lives around the world. We are grateful to the partners we’ve had a chance to work with along the way, beginning with the nine organizations we made loans to in 1996.

We mark our 25th year with reflection and a renewed commitment to think bigger, move faster, and work together to tackle these global challenges. The clarity of our vision, the strength of our mission, and the experience and knowledge we have built up over the past 25 years anchor our work and point us towards the future.

A New Three-Year Strategy to Guide our Work

We released our 2020-2022 Strategic Plan in March, with a reflection on how our strategy has and will continue evolve in the face of COVID-19.

Our new 2020 – 2022 Strategy, released in April, did not anticipate a crisis like the one we now find ourselves facing. While the world has changed significantly since we developed this strategy, its focus on the need for bold, urgent action in response to our shared global challenges has become even more relevant. Our strategy was developed with the recognition that we don’t have much time, and that we must move bigger, move faster, and move together if we hope to change our financial system to value people and planet over short-term profits. All our work is anchored in the same core purpose: to use capital, in innovative and collaborative ways, to create a more equitable and sustainable world.

Read our 2020-2022 Strategic Plan

Read more:

- Jennifer Pryce, CEO, discusses new trends, ideas, and innovations for impact investing with Gayle Peterson, Programme Director of the Oxford Impact Investing Programme

Supporting our partners throughout the pandemic in navigating their new realities

We have worked with partners across the country to support small businesses and nonprofits, especially those operating in low-income communities and run by women and people of color, with affordable, flexible capital and technical assistance as they navigate the pandemic.

Small businesses across the country face enormous challenges in keeping their doors open and supporting their employees in the face of the pandemic. After many were left behind by government relief programs like the Paycheck Protection Program (PPP), we turned to committed and mission driven CDFI partners to help provide urgently needed flexible, affordable capital to the smallest of small businesses. Through cross-sector partnerships, we supported the development of recovery funds like the New York Forward Loan Fund (NYFLF), the California Rebuilding Fund, and efforts to replicate this structure across the country. These recovery funds involve broad collaboration across state and local governments, banks, corporations, foundations, local community organizations, and CDFIs. The funds have supported certified CDFIs, built over decades, to provide crucial financing to small businesses through trusted partners.

Learn more about the New York Forward Loan Fundand the California Rebuilding Fund

Read more:

- Op-ed: A model to save mom and pop stores– The Financial Times

- Securitization + Blended Finance = Impact– Global Capital

- New York State Small Business Fund Shows Promise Reaching the Unreachable– Next City

- California Rebuilding Fund strengthens regional community development financing infrastructure– ImpactAlpha

- When Big Banks Failed, Small Lenders Saved Small Businesses– Crain’s New York

- New York Forward loan helped me keep the doors open, owner says– Newsday

- How Tri-Sector Collaboration is Critical in Creating COVID-19 Response Funds– Duke Fuqua CASE

- Covid Relief and Recovery: From Products to Places– The New Localism

- What Comes Next for Small Business?– Nowak Metro Finance Lab

We have also worked to provide support for our borrowers and portfolio partners so they can best meet the needs of their communities during the pandemic.

Calvert Impact Capital and our partners are committed to supporting both investors and communities in creating near-term and long-term solutions to the crisis. To that end, we released a series of blogs highlighting relief efforts from our partners across sectors serving small businesses and communities across the globe (see: small business/CDFIs, affordable housing, and microfinanceblogs). We also published a blog discussing our portfolio monitoring effortsthroughout the pandemic to keep our investors and partners aware of our strategies and processes during this time.

For more information on our COVID-19 response, check out the COVID-19 resource pageon our website.

Expanding our commitments to racial justice and environmental sustainability

Calvert Impact Capital's mission is rooted in addressing structural inequalities. Our impact strategy is to channel capital to communities traditionally excluded from our financial system, particularly women and communities of color, and this is a key reason for why, in 2020, we signed the Racial Justice Investor Pledge. We also published “Justice, Equity, and Opportunity,” a statement of our commitment to creating a financial and economic system that prioritizes the life and worth of people and the delicacy of our planet. Additionally, we wrote a blog highlighting our borrower’s statements on racial justiceand equity. Our impact strategy is supported by our investor community: 36% of investors state racial justice and equity is a top concern and 70% are more interested in investing to support racial equity since spring 2020.

We continued to match investor interest in environmental sustainability with growing deployment and partnerships in the sector.

Mirroring portfolio demand and investor interest, our Q3 portfolio growth was largely in environmental sustainability, which now represents 19.1% of our portfolio—an all-time high for Calvert Impact Capital. This strategic growth was reflected in new portfolio partners like PACE Equity, a company that makes energy efficiency improvements to commercial buildings and through expanded partnerships with existing partners like fund manager, Finance in Motion to support biodiversity conservation and sustainable business practicesin Latin America and Sub-Saharan Africa.

Read More:

- How Investors are Coming up with the Green to Save the Ocean Blue- The Washington Post

- Why Advisors Should Care About Climate Change– ThinkAdvisor

- How COVID-19 is waking up Wall St. to sustainability– HuffPost

Key Milestones and Industry Recognition

Our Community Investment Note® balance exceeded $500 million for the first time as we continue our work to support under-resourced communities across the globe during this year of unprecedented social, environmental, and economic challenges.

In October, our Community Investment Note balance surpassed $500 million for the first time, serving as yet another indicator of the increasing popularity of investing for positive social and environmental impact alongside financial returns. We are continuing to grow to meet the interwoven challenges of COVID-19, structural inequalities and climate change.

We received industry recognition for commitment to sustainable investing from Environmental Finance, MMI/Barron’s, and ImpactAssets.

Calvert Impact Capital was thrilled to be named Asset Manager of the Year (Mid-Sized)by Environmental Finance’s Inaugural IMPACT 2020 Awards.

We were also selected as a finalist for the 2020 Money Management Institute and Barron’s Industry Awards in the 'Asset Manager of the Year (AUM of $25B or less)' category. This category celebrates “a smaller asset manager that exemplifies innovation in delivering better outcomes for investors and financial advisors." We were honored to be considered amongst such an established group of financial institutions.

We were also proud to be selected for the ImpactAssets 50 2020, which recognizes impact fund managers that demonstrate a commitment to generating positive impact.

In October, we released our 2020 Impact Report, which reflects on our 25th anniversary, our COVID response and recovery funds, and impact on businesses and communities across the globe.

Our 2020 Impact Report provides deeper insights into our impact on investors, borrowers, and communities across the globe. This year’s Impact Report highlights our 25th anniversary, includes a timeline of major organizational milestones over the past 25 years, and features case studies on our very first borrowers. The report highlights our continued commitment to fostering equity and opportunity via racial justice and gender equity strategies. We also outline our response to COVID-19 via direct efforts with borrowers as well as cross-sector collaboration to support small businesses across the country.

Read our 2020 Impact Report and check out the highlights.

Doubling down on our commitment to impact and transparency

This year, we were the second Signatory to the Operating Principles for Impact Management to publicly release both a disclosure statement and verification statement, demonstrating our commitment to impact management disclosure and transparency.

In March, we were the second Signatory to release our impact disclosure statement and verification statement. We engaged Tideline Verification Services, now BlueMark, a woman-owned impact investing advisory firm, to conduct the inaugural verification of our impact measurement and management (IMM) system.

Our disclosure statement and Tideline’s verification statement validates that:

- Calvert Impact Capital is built to create positive impact, as demonstrated by our strategy, our portfolio, and our policies and procedures;

- Our impact management practices are advanced in understanding our positive Community Impact, as well as our contribution to the market through our Investor Impact and Portfolio Impact;

- We take an active learning approach that identifies best-in-class practices and incorporates these new standards into our work.

Beyond the stated requirements of the Principles, we released the results of the verification, including Tideline’s assessment of the degree to which our IMM practices align with the Principles as well as Tideline’s recommendations for improvement.

Read our blog discussing the Principles and summarizing the findings of the verification

Read our full Impact Disclosure Statement and Verification Statement for the findings of our verification, as well as an outline of our IMM Framework and practices

We collaborated to create an investor handbook that outlines best practice for optimizing both impact and financial returns.

Calvert Impact Capital is one of the 13 impact investing firms that make up the first cohort of the Impact Frontiers Collaboration, a group led by the Impact Management Project that supports investors to pioneer new ways to integrate impact alongside financial risk and return in investment practices. In June, the group published its Investor Handbook on Impact-Financial Integration, which outlines the impact-financial integration methods that were developed and implemented with the Collaboration.

Read the handbookand an accompanying articlepublished in the Stanford Social innovation Review

Check out our new Impact Insights Pagefor more resources on all things IMM

Read more:

- Impact Investing’s Next Chapter: Integrity Through Assurance Webinar

- Jenn Pryce, CEO, Smart and Soulful Money Podcastto discuss how the SDGs can help us focus our impact

- Caitlin Rosser, Sr. Officer of Impact & Communications, Webinar on How to implement impact and financial integration techniques, with the Impact Management Project

Continuing to better understand and serve the needs of our diverse investor base

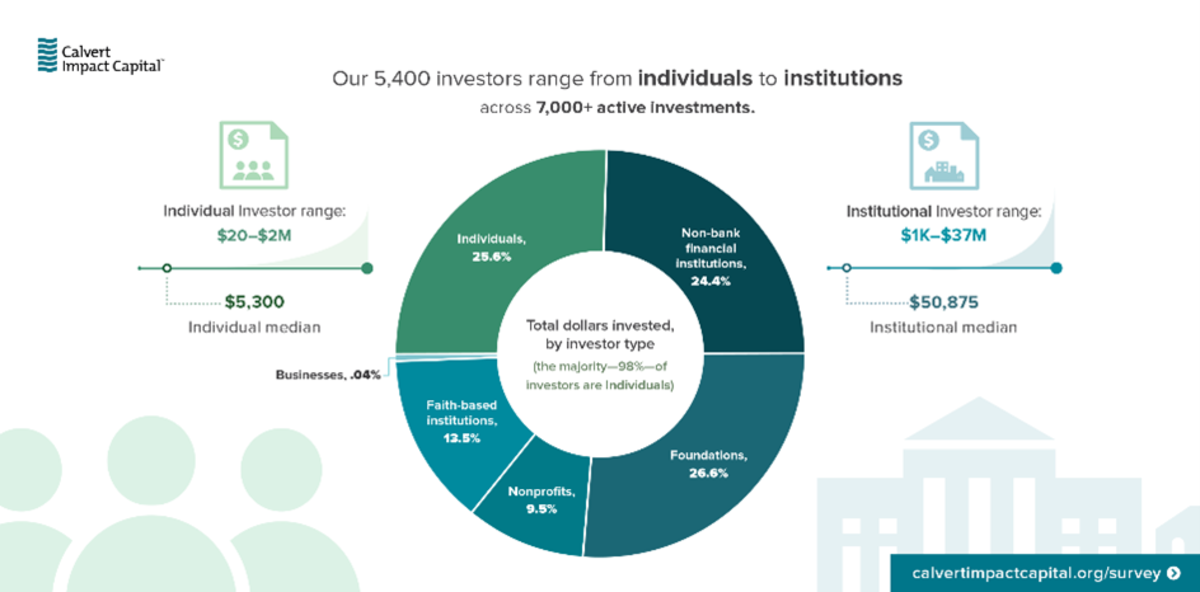

We conducted our bi-annual Impact Investor Survey to better understand the motivations of our investor base, the challenges they face in investing for impact, and how we can serve them better.

We launched our biannual investor survey in February, shortly before the COVID-19 pandemic hit the US. Needless to say, most people had things other than surveys on their minds. However, as the world began to adjust, we heard from investors and advisors that they were more interested in impact investing than ever before. We wanted to capture this surge of interest in impact investing, as well as the increased interest in investing for racial justice and equity, so we relaunched our survey in June 2020.

Our 2020 Impact Investing Surveyshowed high investor interest in Environmental Sustainability, the top issue named by respondents. Since our 2016 survey, environmental sustainability has been rated as the #1 issue in nearly every demographic group. Renewable energy was also rated a top issue by 26% of investors. Additionally, 62% of investors explicitly responded that they invest “to positively influence climate change.”

As a result of this continued interest, we expanded our investments in climate solutions.

More than 700 people responded to the survey, providing key insights which you can read about in our blog on key survey takeaways. For more information on our investors and why they invest for impact, download the Investor Infographic.

In March we announced new updates to our online investing platform in order to make impact investing more accessible and easier for a diverse range of investors.

In March, we unveiled updates to our online investing platformthat were designed in response to feedback from investors. These updates include the ability to combine multiple transactions into a single Community Investment Note®, see summarized account information in one place, and add desired communications and payment preferences.

Read more:

Thanks for partnering with us in 2020

We look forward to working together in 2021! Be sure to sign upfor our email updates below to get the latest happenings.