Portfolio List

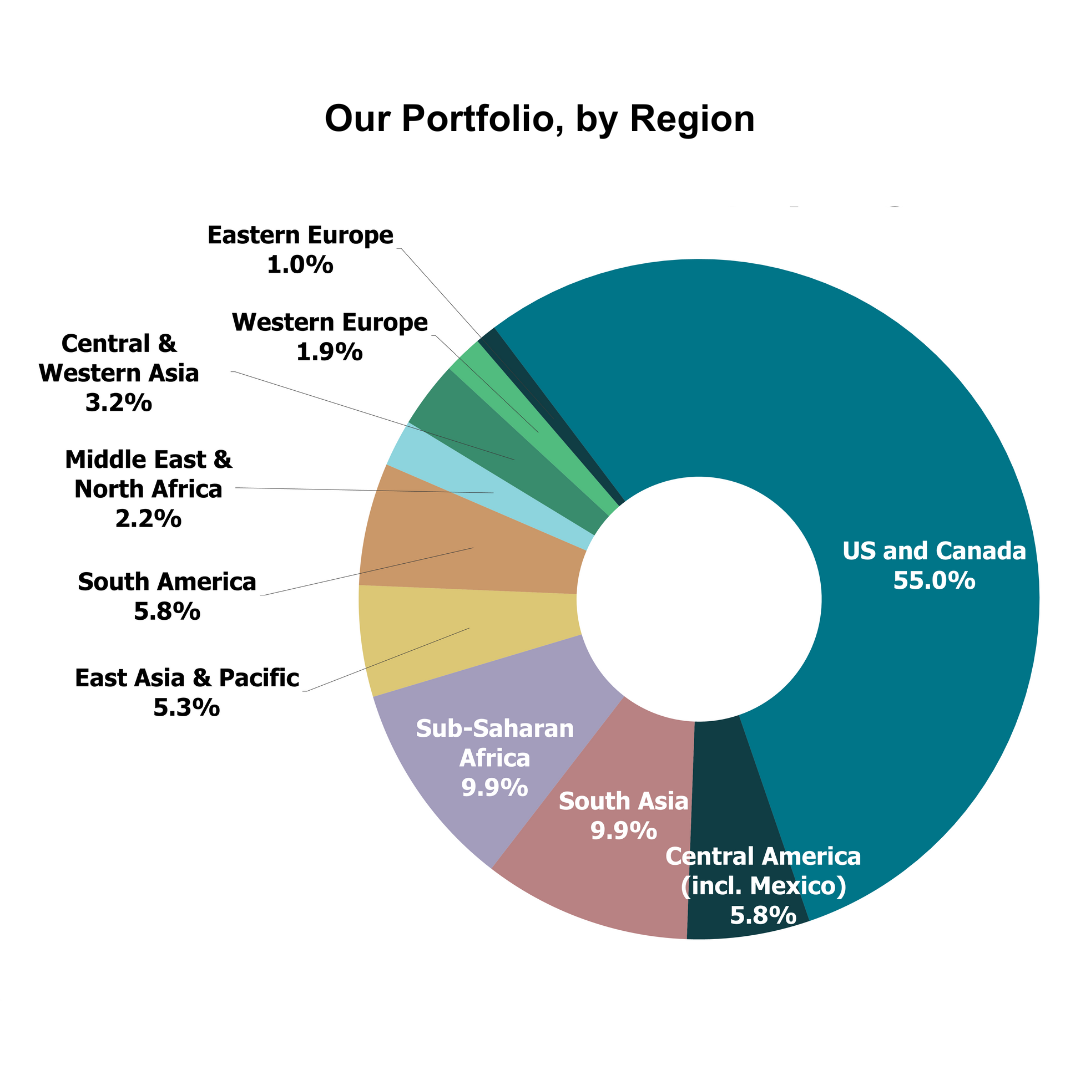

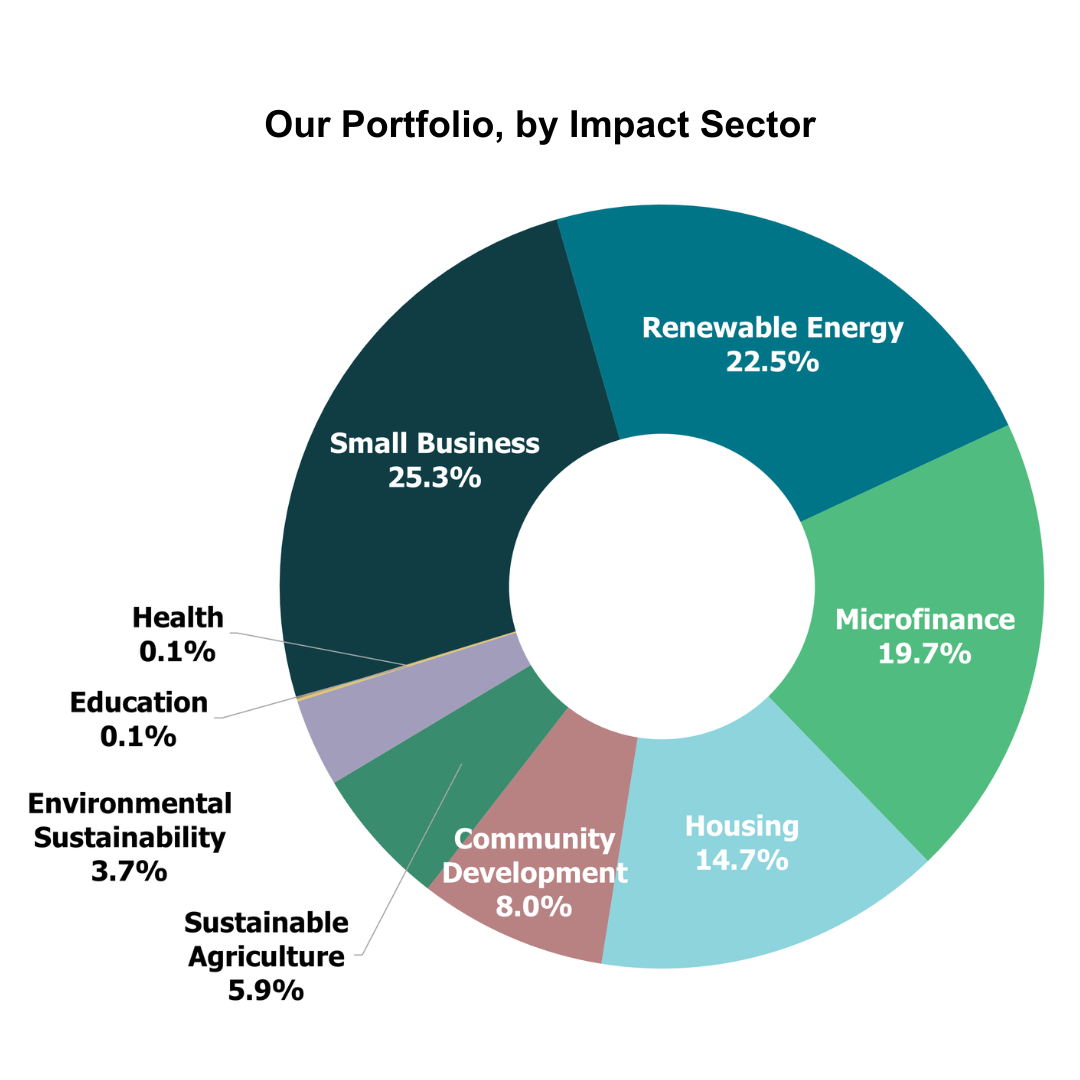

The Community Investment Note portfolio is a diverse mix of over 100 organizations that operate across a range of sectors and geographies. We continuously add new organizations to our portfolio and graduate others out of our portfolio. Click on each portfolio partner to learn more.

Organization

Sectors & Topics

Region

Country

US State

Sustainable Agriculture

Sustainable Agriculture

Environmental Sustainability

Environmental Sustainability

Gender Equity

Gender Equity

Small Business

Small Business

Small Business

Small Business

Microfinance

Microfinance

Gender Equity

Gender Equity

Small Business

Small Business

Gender Equity

Gender Equity

Small Business

Small Business

Health

Health

Renewable Energy

Renewable Energy

Small Business

Small Business

Gender Equity

Gender Equity

Affordable Housing

Affordable Housing

Community Development

Community Development

Affordable Housing

Affordable Housing

Community Development

Community Development

Environmental Sustainability

Environmental Sustainability

Renewable Energy

Renewable Energy

Small Business

Small Business

Sustainable Agriculture

Sustainable Agriculture

Small Business

Small Business

Gender Equity

Gender Equity

Affordable Housing

Affordable Housing

Community Development

Community Development

Environmental Sustainability

Environmental Sustainability

Environmental Sustainability

Environmental Sustainability

Health

Health

Gender Equity

Gender Equity

Environmental Sustainability

Environmental Sustainability

Sustainable Agriculture

Sustainable Agriculture

Small Business

Small Business

Environmental Sustainability

Environmental Sustainability

Microfinance

Microfinance

Environmental Sustainability

Environmental Sustainability

Gender Equity

Gender Equity

Small Business

Small Business

Microfinance

Microfinance

Microfinance

Microfinance

Affordable Housing

Affordable Housing

Environmental Sustainability

Environmental Sustainability

Education

Education

Sustainable Agriculture

Sustainable Agriculture

Renewable Energy

Renewable Energy

Small Business

Small Business

Gender Equity

Gender Equity

Affordable Housing

Affordable Housing

Community Development

Community Development

Education

Education

Health

Health

Gender Equity

Gender Equity

Affordable Housing

Affordable Housing

Community Development

Community Development

Education

Education

Small Business

Small Business

Gender Equity

Gender Equity

Environmental Sustainability

Environmental Sustainability

Renewable Energy

Renewable Energy

Environmental Sustainability

Environmental Sustainability

Sustainable Agriculture

Sustainable Agriculture

Affordable Housing

Affordable Housing

Community Development

Community Development

Community Development

Community Development

Affordable Housing

Affordable Housing

Community Development

Community Development

Education

Education

Microfinance

Microfinance

Gender Equity

Gender Equity

Microfinance

Microfinance

Small Business

Small Business

Gender Equity

Gender Equity

Microfinance

Microfinance

Small Business

Small Business

Gender Equity

Gender Equity

Small Business

Small Business

Small Business

Small Business

Small Business

Small Business

Small Business

Small Business

Small Business

Small Business

Gender Equity

Gender Equity

Affordable Housing

Affordable Housing

Community Development

Community Development

Affordable Housing

Affordable Housing

Community Development

Community Development

Gender Equity

Gender Equity

Environmental Sustainability

Environmental Sustainability

Affordable Housing

Affordable Housing

Small Business

Small Business

Gender Equity

Gender Equity

Small Business

Small Business

Microfinance

Microfinance

Gender Equity

Gender Equity

Small Business

Small Business

Microfinance

Microfinance

Microfinance

Microfinance

Gender Equity

Gender Equity

Microfinance

Microfinance

Gender Equity

Gender Equity

Renewable Energy

Renewable Energy

Small Business

Small Business

Gender Equity

Gender Equity

Environmental Sustainability

Environmental Sustainability

Renewable Energy

Renewable Energy

Community Development

Community Development

Environmental Sustainability

Environmental Sustainability

Education

Education

Health

Health

Sustainable Agriculture

Sustainable Agriculture

Renewable Energy

Renewable Energy

Small Business

Small Business

Gender Equity

Gender Equity

Affordable Housing

Affordable Housing

Community Development

Community Development

Gender Equity

Gender Equity

Environmental Sustainability

Environmental Sustainability

Renewable Energy

Renewable Energy

Affordable Housing

Affordable Housing

Community Development

Community Development

Affordable Housing

Affordable Housing

Small Business

Small Business

Gender Equity

Gender Equity

Affordable Housing

Affordable Housing

Community Development

Community Development

Environmental Sustainability

Environmental Sustainability

Sustainable Agriculture

Sustainable Agriculture

Renewable Energy

Renewable Energy

Environmental Sustainability

Environmental Sustainability

Environmental Sustainability

Environmental Sustainability

Renewable Energy

Renewable Energy

Small Business

Small Business

Renewable Energy

Renewable Energy

Small Business

Small Business

Gender Equity

Gender Equity

Affordable Housing

Affordable Housing

Community Development

Community Development

Health

Health

Education

Education

Gender Equity

Gender Equity

Environmental Sustainability

Environmental Sustainability

Small Business

Small Business

Sustainable Agriculture

Sustainable Agriculture

Environmental Sustainability

Environmental Sustainability

Sustainable Agriculture

Sustainable Agriculture

Renewable Energy

Renewable Energy

Gender Equity

Gender Equity

Sustainable Agriculture

Sustainable Agriculture

Environmental Sustainability

Environmental Sustainability

Small Business

Small Business

Gender Equity

Gender Equity

Microfinance

Microfinance

Gender Equity

Gender Equity

Small Business

Small Business

Our former borrower ECLOF International is a pioneer in the microfinance and sustainable agriculture sectors. Isidro Montas (pictured) is a client of ECLOF Dominican Republic. He runs a thriving lemon, avocado, and decorative palm farm. Isidro says that he owes this success to his passion for work and ECLOF’s economic advice.

Our former borrower ECLOF International is a pioneer in the microfinance and sustainable agriculture sectors. Isidro Montas (pictured) is a client of ECLOF Dominican Republic. He runs a thriving lemon, avocado, and decorative palm farm. Isidro says that he owes this success to his passion for work and ECLOF’s economic advice.