Blog

2022 In Review

With a new strategy, an updated name, and many milestones achieved, 2022 was an exciting and productive year for Calvert Impact. The need for a sustainable investment transition is clear and there continues to be unprecedented levels of interest in impact investing. This presents a great opportunity—but one that requires new approaches and a better market infrastructure to be fully realized – things that we look forward to working on in the new year.

A Foundational Plan for the Next Three Years

This fall we released our 2023-2025 Strategic Plan and announced a new corporate structure that will allow us to expand our platform, create new products, and provide better access to impact opportunities in the coming years.

As part of this, we created an umbrella name, Calvert Impact, that covers our growing scope of activities.

Supporting Stronger Banks, Stronger Communities

In December, we announced another exciting initiative to foster a stronger, more sustainable, and more inclusive banking system: the Mission Driven Bank Fund. The Federal Deposit Insurance Corp. (FDIC) encouraged the development of the Mission Driven Bank Fund (the Fund), a private investment vehicle to support insured Minority Depository Institutions (MDIs) and Community Development Financial Institutions (CDFIs). Microsoft and Truist signed on as anchor investors to lead the investment fund and hire a fund manager. Late this year, we were chosen alongside Elizabeth Park Capital Management to co-manage the Fund. Strategic Value Bank Partners and West Potomac Capital LLC will serve as subadvisors.

The Fund will provide capital and support to mission-driven banks that extend credit and financial services to lower-wealth communities, rural communities, and communities of color across the United States.

Learn more on the Mission Driven Bank Fund website.

Lessons Learned from Supporting Small Businesses

When COVID swept the globe in 2020, small businesses across the country were hit hard by the economic fallout. We worked with CDFI partners to provide flexible, affordable capital through five recovery funds. Over the past two years, the funds, which involved broad collaboration across state and local governments, banks, corporations, foundations, local community organizations, and CDFIs, have provided loans to more than 3,500 small businesses in 18 states.

This year, we engaged 60 Decibels, a leading impact evaluation firm, to take a close look at the impact of the funds and have released two reports on the New York Forward Loan Fund and the California Rebuilding Fund. 60 Decibels spoke directly with small business owners and learned that loan recipients of both funds reporting reduced stress levels, increased ability to manage finances, increased ability to maintain jobs, and other positive impacts as a result of the loans.

Learn more about the reports:

Read more about the impact of the recovery programs:

- Small Business Flex Fund exceeds $100 million goal to support equitable recovery for Washington small businesses, announces extended application timeline - PR Newswire

- CDFIs are starting to flex their post-pandemic clout - American Banker

- Small business grants overshadow loan program in COVID-19 response - CalMatters

What’s on our investors’ minds? 2022 Impact Investor Survey lets us know

In the spring, we launched our bi-annual Impact Investor Survey, which we conduct to better understand the motivations of our current investors and the broader investment community as well as the challenges they are facing.

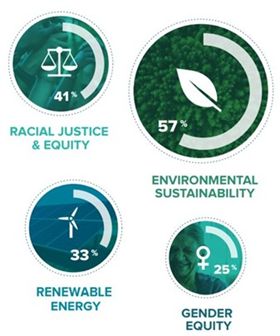

The 2022 Impact Investor Survey, which polled almost 800 people, found that mitigating climate change and addressing gender and racial inequities remained among the top motivators of investors. Since our 2016 survey, environmental sustainability has been rated as the #1 issue in nearly every demographic group. Renewable energy was also rated a top issue by 33% of investors (an increase of 7% from 2020). Additionally, 67% of investors explicitly responded that they invest “to positively influence climate change” (up 5% from 2020).

Financial advisors are eager to make more impact investments on behalf of their clients. Whether it’s to address climate change or racial equity, most financial advisor respondents reported having made at least one new impact investment since 2020, and 88% of advisors plan to increase the amount of those investments in their clients’ portfolios over the next year.

For more information on our investors and why they invest for impact, download the Investor Infographic.

Read more about the survey results:

- Generation X leads rise in impact investing uptake- Impact Investor

- Impact Investors Focus On Climate Change, Racial Equity, Covid-19- Forbes

- From Intention To Action: Nonprofits Show Most Interest In Impact Investments- FinNews - Impact funds getting more attention as investors seek to address climate change, racial equity- InvestmentNews

Capital in Action

Our staff have the opportunity to see our capital at work during site visits to our portfolio partners. In 2022 our staff shared their experiences visiting partners working on wildfire prevention, community-based solar, and affordable housing.

Read about their experiences:

- Site Visit: Forest Resilience Bond

- What does Community-Based Solar Look Like?

- Acrecent Financial Corporation’s work in Puerto Rico

Milestones and Industry Recognition

In early 2022 we launched a new partnership with 8 Billion Trees to offset the carbon emissions of our new office and our commuting staff. 8 Billion Trees is a small business that sells carbon-offsets and runs large-scale planting operations in the Amazon rainforest.

Our third annual disclosure statement as a Signatory to the Operating Principles for Impact Management provides insight into our robust impact management and measure practices. Motivated by the Principles, we launched a “Success Stories” series to share insights from partners who graduate out of our portfolio and shared several new case studies in 2022.

In November, we released our 2022 Impact Report. The annual report celebrates the impact of our portfolio partners and our investors, who make our work possible. Between building affordable homes, financing small businesses, investing in education, and more, our partners have done remarkable work in their communities. Read about their work.

We were also proud to be selected for the ImpactAssets 50 2022, which recognizes impact fund managers that demonstrate a commitment to generating positive impact, marking our 11th year on the IA 50 list.

Thanks for partnering with us in 2022

We look forward to working together in 2023! Be sure to sign up for our email updates below to get the latest happenings.