Blog

Calvert Impact’s commitment to small businesses

Calvert Impact has supported small businesses since our founding nearly 30 years ago. Read about history of our work in small business finance, how our strategy has evolved, and what is in store for the future.

A Bridge to Capital

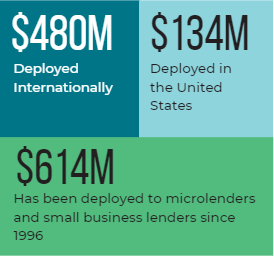

In the late ‘80s, the microlending movement was born in the United States. Organizations deeply committed to getting capital to the most marginalized entrepreneurs, such as the Lakota Funds in 1986, sprung up around the country. While these organizations were successful in providing much needed loans to their communities, funding for the microlenders themselves was more elusive. Calvert Impact (then called Calvert Foundation) began our modern operations in 1995 with the idea that investors should be able to directly support their communities, investing in microlenders and other community-focused capital providers, not just the S&P 500. Among the first batch of loans approved by our investment committee was a loan to ACCION USA, the first of hundreds of loans to community lenders that ultimately supported entrepreneurs and small businesses in the US. Since then, Calvert Impact has provided $134 million in financing to microlenders and small business finance intermediaries across the country.

Deployment metrics are reflective Community Investment Note portfolio

Market Maturation

The community finance industry in the US grew rapidly between 1995-2020, spurred by the US Treasury Department’s Community Development Financial Institutions (CDFI) Fund. The CDFI Fund was founded in 1994 to provide federal funding that community organizations could leverage with private capital. CDFIs are loan funds, like the Lakota Funds, as well as banks, venture capital funds, and credit unions that work to mobilize capital for underserved communities. Coupled with growing interest from banks interested in lending to community finance organizations for Community Reinvestment Act (CRA) credit and critical financial infrastructure like Calvert Impact, the size, reach, and number of small business finance intermediaries exploded across the US.

One such organization, New Hampshire Community Loan Fund (Community Loan Fund), received its first loan from Calvert Impact in 1997 for $150,000. The Community Loan Fund lends holistically to support community development, providing small business loans and affordable housing loans. Our partnership with Community Loan Fund continued for over 20 years during which time its portfolio grew from $10 million in the early 2000s to $145 million by the end of 2021. Our loan size expanded alongside their expanding capital needs to $6.5 million. Community Loan Fund repaid their loan in March 2022 after launching its own retail investment product.

The Community Loan Fund provided a loan to Yahso Jamaican Grille to move to a larger space: “I got a sense that there was a partnership, beyond just a financial partnership,” says owner Gail Somers. Kate and Keith Photography, Courtesy of NH Community Loan Fund.

Like the Community Loan Fund, the community finance industry has grown and matured, as have the financing options. Many CDFIs now have access to low-cost, affordable balance sheet capital from foundations, banks, and a public sector that have grown both more aware of CDFIs and enthusiastic to support their efforts*. Yet these small business community lenders remain chronically under-capitalized with over 75% of surveyed CDFIs expressing an “urgent” or “somewhat urgent” need for capital over the next 6-12 months. How can this be?

Building a New Kind of Bridge

The challenge is liquidity.

Traditional financial markets rely on secondary markets to recycle capital. Without access to the secondary market, CDFIs' lending volume is limited by the size of their balance sheets, specifically the equity available to leverage. And equity—in the form of grant dollars for CDFIs—is highly competitive and in short supply.

Liquidity has long been a challenge but was felt most acutely at the start of the pandemic in 2020. With struggling small businesses around the country and CDFIs initially lacking access to the Paycheck Protection Program, Calvert Impact came together with our partners including the Community Reinvestment Fund and National Development Council to create five Small Business Recovery Funds to provide flexible, affordable capital to the smallest small businesses across the country. The recovery funds are centralized loan purchase facilities capitalized by public, private, and philanthropic lenders that increase CDFI small business lending capacity by purchasing 95% of every eligible small business loan from community lenders. This created a secondary market, freeing community lenders so they could do more lending than their balance sheet allowed. For every $1 of a CDFI’s available funds, this program enables them to offer $20 of loan capital to a small business.

And loan capital is just the beginning. The model we developed with our partners combines secondary loan purchases with a technology platform to support originations and technical assistance for business owners applying for credit. This holistic approach is designed to build local CDFI capacity so that community lenders can do what they do best in reaching more small businesses in underbanked communities. The Recovery Funds have taught us much about what is possible for community lenders, and the small businesses they serve, when there is an effective secondary market to serve their needs. In partnership with over 40 community lenders, the Recovery Funds have supported more than 5,500 small businesses, nearly 70% of them led by women or people of color.

Cumulative job metrics inclusive of both the Community Investment Note portfolio and Recovery Funds work

In our 2023-2025 strategic plan, Calvert Impact shared a new organizational structure, one that shifted us from selling one single product—the Community Investment Note—to offering a multi-product and service platform. This strategy has allowed us to build additional infrastructure in the form of the new Calvert Impact Small Business, a subsidiary limited liability corporation designed to leverage State Small Business Credit Initiative (SSBCI) funds using the model piloted with our Recovery Funds. Calvert Impact Small Business has helped us evolve to meet the growing needs of the small business community lenders with whom we work.

Over the last ten years, Calvert Impact’s portfolio and our Recovery Fund partners have collectively provided $4.5B in financing to nearly 230,000 estimated small- to medium-sized enterprises. Using both new, innovative tools and longstanding ones, Calvert Impact will continue our commitment to making sure that our partners have the capital they need to create a more sustainable and equitable world.

*This increased access to balance sheet loans has not been uniformly enjoyed by the entire CDFI sector—smaller, rural, and minority-led and minority-serving CDFIs have all historically had much less access to these opportunities. This is due to many factors such as investors lacking the capacity to do smaller-dollar loans, institutionalized racism, and past CRA policy. Strong intermediary organizations and CDFI collaborations such as Oweesta, the African American Alliance of CDFI CEOs, and the Partners for Rural Transformation have emerged to support advocacy efforts and capital access for community lenders that have had a more challenging time connecting to the growing CDFI-lending market.