Blog

Small Businesses, Big Impact: Our Commitment to the Engines of Economic Growth

Small businesses are the lifeblood of economies and a vital conduit for reaching communities. At Calvert Impact, our commitment to supporting small and medium enterprises (SMEs) has been unwavering since our founding in 1995. Our investment approach (in terms of financial instruments, structuring, partnerships, and geographic scope) has expanded and evolved alongside the markets we serve but remains grounded in a belief that access to capital is essential for sustainable economic growth.

Within our longest-standing and largest privately capitalized portfolio, the Community Investment Note®, we partner with intermediaries—such as fund managers, non-bank financial institutions (NBFIs), housing developers, and other community-facing entities— around the world that are best positioned to respond to local challenges with tailored market solutions. We aggregate private capital and direct it in response to the evolving needs of these community-facing partners and in so doing, help bridge the gap between global capital markets and local opportunities. As markets shift, we remain agile and responsive—committed to supporting our intermediary partners to scale their solutions sustainably.

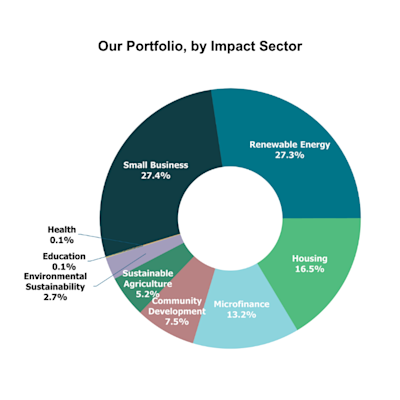

Small Business is the largest and fastest growing sector of the Note® portfolio, channeling capital to businesses that are often overlooked by traditional finance.

Market Dynamics and Opportunities

While our small business portfolio is global, the three most prominent markets we serve in this sector are the U.S., India, and the African continent. Each presents distinct opportunities and challenges that shape our approach.

United States

Small businesses are a cornerstone of the U.S. economy—representing 99% of all firms, contributing over 43% of GDP, and accounting for the majority of net new job creation over the past two decades. Yet despite their critical role, U.S. small businesses continue to face persistent challenges in accessing capital. This is especially acute among smaller, women- and minority -owned enterprises, which are disproportionately denied financing, as highlighted by the Federal Reserve’s latest small business credit survey .

Our work in the U.S. small business sector has deep roots in Community Development Financial Institutions (CDFIs), where we played a pioneering role in the 1990s to help prove the creditworthiness of these community lenders. CDFIs have been instrumental in reaching historically underserved markets and continue to serve as essential infrastructure for equitable economic development. Over time, as the CDFI space has matured and more capital has become available at lower cost, we’ve supported CDFIs in new ways that meet their current needs and i n parallel, we’ve expanded our focus to include new models—particularly those that leverage technology, policy innovation, and localized expertise to broaden access to credit. Outside of the Community Investment Note portfolio, we also partner with CDFIs to support small businesses by leveraging funds from the State Small Business Credit Initiative and bringing access to capital and technical assistance to historically un- and under-banked small businesses.

We currently see strong potential in employee ownership models, especially given that over half of privately held U.S. businesses are led by owners over 55. Facilitating transitions to employee ownership not only preserves local jobs and businesses, but also fosters inclusive wealth-building, diverse leadership, and community stability. From legacy partnerships with CDFIs to emerging solutions in fintech and inclusive ownership, our U.S. small business strategy reflects both continuity and evolution—grounded in the belief that targeted capital can unlock transformative outcomes for communities across the country.

India

India has emerged as one of the most compelling markets for small business finance within our international portfolio. Over the past eight years, we’ve seen consistent growth driven by a combination of favorable structural and regulatory dynamics, and a strong ecosystem of local partners. Our strategy in India is aligned with our risk-return-impact objectives and reflects the strength of five key market drivers:

- Robust Local Partnerships – We work with seasoned, mission-aligned intermediaries who have deep roots in their communities and a strong track record of serving underserved SMEs.

- Economic Resilience – India’s diverse and growing economy continues to demonstrate resilience amidst global volatility, creating a stable backdrop for long-term investment.

- Market Diversification – The Indian market offers exposure to a wide variety of sectors, geographies, and borrower profiles, enhancing portfolio diversification.

- Data Availability – Advances in India’s digital public infrastructure have led to greater availability of borrower data, enabling more sophisticated credit underwriting and risk monitoring.

- Ease of Doing Business – A supportive regulatory environment has allowed for the development of intermediary-to-intermediary lending structures—providing us with pathways to scale impact through layered intermediation.

Africa

Africa’s small business landscape is rich with potential, though not without complexity and regional nuance. SMEs form the backbone of the continent’s economies yet face persistent challenges in accessing capital and scaling sustainably. Our approach recognizes the diversity of the region—economically, geographically, and culturally—and seeks to partner where the right mix of market fundamentals and impact potential converge.

While micro-enterprises dominate the small business landscape, it has become increasingly clear that mid-to-large companies can play an outsized role in advancing economic growth. These “business baobabs” have deep roots in local markets and create enabling ecosystems for micro and small enterprises. They provide higher wages, generate tax revenues, strengthen supply chains, and serve as catalysts for innovation and productivity gains.

Africa’s demographic trajectory also presents a defining opportunity: by 2040, the continent is expected to have the world’s largest working-age population. Harnessing this labor force through productive, formal employment is critical to avoiding a demographic dividend turning into a crisis. Mid-to-large firms are central to absorbing this workforce and unlocking long-term economic resilience.

The rise of inclusive fintech is also transforming SME finance across Africa. According to CGAP, nearly 270 inclusive credit fintechs in Africa have raised over $4 billion in the past decade—accounting for one-third of all fintech funding on the continent. These platforms are helping to modernize SME lending by leveraging technology to extend credit more efficiently and inclusively.

Our portfolio reflects these dynamics focusing on borrowers who are building the connective tissue between financial innovation and inclusive growth. As we continue to deepen our work in Africa, we remain focused on identifying fund managers and platforms that are scaling responsible and inclusive lending models and supporting the next generation of business leaders across the continent.

Conclusion

Our experiences have illuminated the importance of adaptive strategies in small business financing. The rise of fintech has revolutionized access to capital, particularly in emerging markets, necessitating a nuanced understanding of technological and regulatory landscapes. Additionally, the shift towards multi-layered intermediation underscores the value of partnerships with entities that possess deep local insights and networks and the importance of ethical pricing and lending practices.

As we chart our path forward, our focus remains on identifying and nurturing opportunities that align with our intermediary strategy designed to strengthen local market capacity. Our strategy of working through intermediaries such as fund managers, non-bank financial institutions (NBFIs), and other community-facing entities that are best positioned to respond to local challenges with tailored, place-based market solutions allows us to leverage our historical insights while remaining agile to capitalize on emerging trends and innovations in the small business ecosystem. These partners are deeply embedded in their geographies and sectors, and their work reflects the realities and opportunities on the ground. Beyond capital, they often offer technical assistance to support their small business borrowers’ success.

We continue to listen to and build on our global network of financing partners, scaling with them as they grow throughout economic cycles. Our commitment to the small business sector is not just about capital allocation; it's about fostering ecosystems where businesses can thrive, contributing to economic growth and community development.