Blog

Celebrating Small Businesses Every Week

This week, April 30-May 6th, is National Small Business Week. The U.S. Small Business Administration has celebrated the week for more than 50 years, honoring the perseverance and hard work of US entrepreneurs. Calvert Impact has a long-standing history of supporting small businesses, and we are reflecting on what this legacy has taught us about the small business finance sector.

Long-Term Commitment

This February, Calvert Impact a blog about our nearly thirty years of experience in the small business finance sector. This blog details our continued adaptation to meet the needs of the evolving small business finance sector starting with our work in the microlending movement through the more mature market today. Through responsive and creative approaches, Calvert Impact has deployed more than $134M in financing to microlending and small business finance intermediaries around the country. Calvert Impact’s portfolio and Recovery Funds partners have collectively provided $4.5B in financing to nearly 230,000 estimated small- to medium-sized enterprises over the last ten years.

Documenting Outcomes

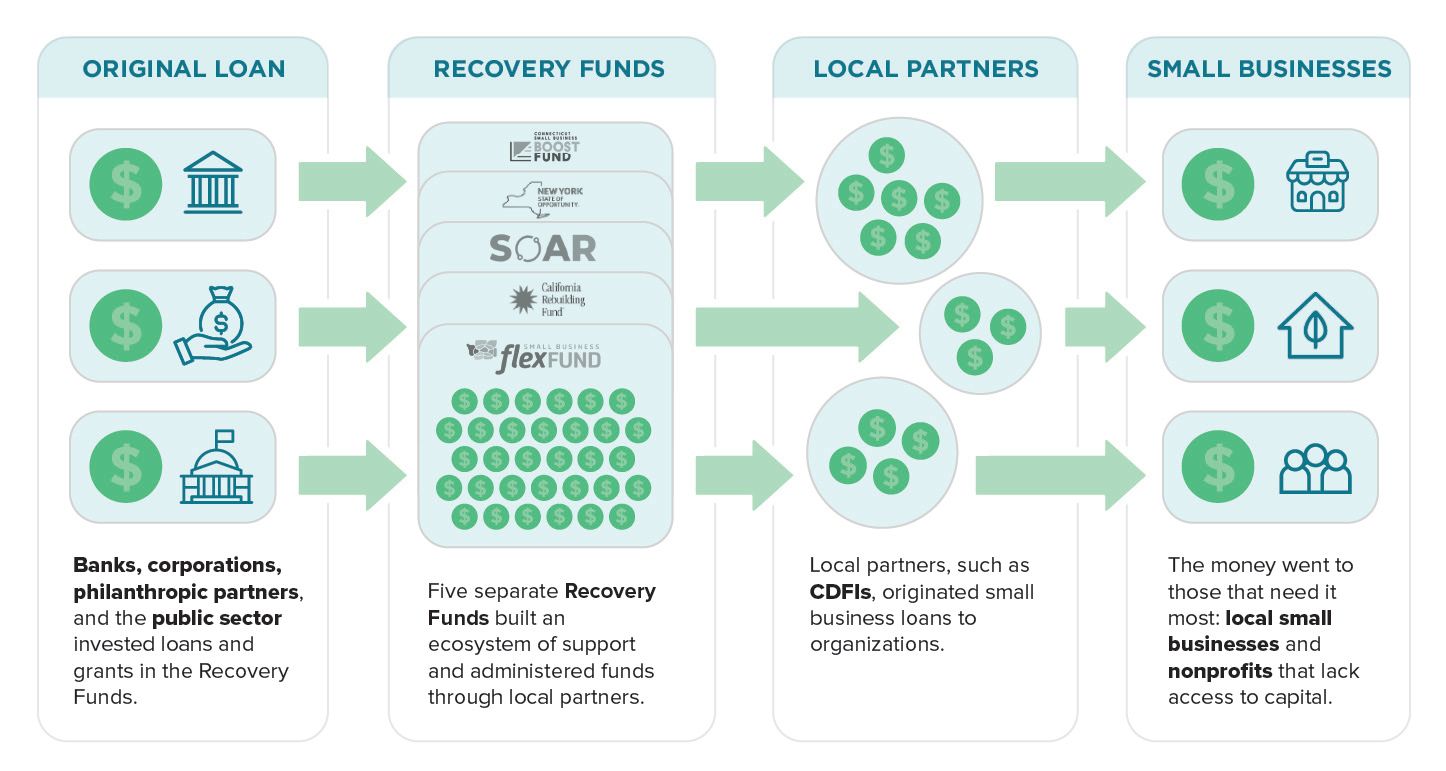

When COVID swept the globe in 2020, small businesses across the country were hit hard by the economic fallout. We worked with CDFI partners to provide flexible, affordable capital through five recovery funds. Over the past two years, the Recovery Funds, which involved broad collaboration across state and local governments, banks, corporations, foundations, local community organizations, and CDFIs, have provided loans to more than 5,500 small businesses in 18 states.

We recently released a report documenting the impact of one of these funds, the Southern Opportunity and Resilience (SOAR) Fund. 60 Decibels, a leading impact evaluation firm, spoke directly with small business owners and learned that loan recipients reporting reduced stress levels, increased ability to manage finances, increased ability to maintain jobs, and other positive impacts as a result of the loans, echoing similar findings to reports on the New York Forward Loan Fund and the California Rebuilding Fund.

Providing Market Leadership

This summer, Calvert Impact will release a report on small business finance co-authored with the Community Reinvestment Fund and the National Development Council. The report will provide a detailed look at the Recovery Funds – how they were created, why they succeeded, and what they taught us about how we can support the small business finance sector in a more powerful way.

It is difficult to obtain a small business loan in America. Small business lending is no longer considered lucrative enough to be worth the effort for most banks. This credit market is especially tough for small business owners of color who have long lacked access to capital. Business ownership is second only to home ownership as a driver of inter-generational wealth creation, greatly contributing to the racial wealth gap. The report will provide a comprehensive look at the small business finance sector to help us understand why credit access gaps are so persistent – and what we, collectively, can do about it.

Data sourced from 2022 Report on Employer Firms Based on the Small Business Credit Survey and The Fed - Availability of Credit to Small Businesses - October 2022

Emergencies exacerbate existing inequities, and the small business credit market during the COVID-19 pandemic was no exception. To meet the needs of under resourced and overlooked small business owners, the pandemic forced large-scale innovation through the Recovery Funds model. The Recovery Funds created centralized loan purchase facilities to increase CDFI small business lending capacity by purchasing 95% of every eligible small business loan from community lenders. This created a secondary market, freeing community lenders so they could do more lending than their balance sheet allowed.

Recovery Funds efforts provide a roadmap for how to scale the CDFI market for small business lending with integrity and remain true to the mission of the CDFI field. The report will call for policy makers, banks, and investors to provide support around five key areas to foster innovation and further market development in community finance.

Be sure to sign up for our email updates to be notified when the report launches.

New Webinar Series

In addition to our recovery fund report, we'll also be launching a webinar series to explore the small business finance sector. A preview is below and we'll share details for registration through social media and our newsletter.

Webinar 1: Learning from the Southern Opportunity and Resilience Fund

Calvert Impact, Community Reinvestment Fund, USA, LISC, and 13 Community Development Financial Institutions (CDFIs) came together during the pandemic to create the Southern Opportunity and Resilience Fund (SOAR). SOAR created incredible momentum for the small businesses that received loans across the South and Southeastern United States, and it transformed the collective business models of the CDFI lenders who participated. Join us as we gain insight from the SOAR results and ask the question: how do CDFI small business lenders continue to build momentum after COVID-19?

Webinar 2: A Theory of Change for the Small Business Finance Sector

The small business finance sector is steeped in racial inequity and is the product of broken systems. Join us as we take a closer look at the capital systems that underpin these inequities and what they mean for entrepreneurs of color. Many impact investors, such as Calvert Impact, have chosen to invest heavily over a long period of time in the sector to combat these systematic inequities. How do we know if our investments are successfully addressing these systemic inequalities? Calvert Impact will take a dive into our most recent small business program, the Recovery Funds, sharing our underlying theory of change and impact framework. Leave the webinar with a deeper understanding of the systemic barriers facing entrepreneurs and how to measure the impact of work being done to address the inequities.

Webinar 3: The Future of the Small Business Finance Industry

Calvert Impact’s new report provided key recommendations for how to grow the small business community finance sector. Relying on learning from our most recent small business program, the Recovery Funds, join us as we invite experts to reflect on what is next for the small business finance industry and host an interactive conversation surrounding these recommendations. As we begin to engage this conversation nationally, come share what do you think is necessary to grow the small business community finance sector and to learn about the needs in the field.

Thank you Calvert Impact is proud to support, and celebrate, thousands of small businesses in partnership with financial intermediaries from around the globe. We extend our gratitude to all the small business owners with whom we work. You are a source of inspiration to us, every week.